Why ExpressTruckTax?

ExpressTruckTax is the market-leading Form 2290, e-file provider. In the last ten years, they have processed over $1.5 billion in excise tax payments and served over 600,000 trucking industry professionals.

E-filing Form 2290 HVUT is Easy

With Our Mobile App

Add Taxable Vehicles

Add vehicles with a taxable gross weight of 55,000 pounds or more and provide the vehicle’s VIN and Taxable Gross Weight.

Add Suspended Vehicles

Add vehicles that didn't exceed 5000 miles (7,500 miles for agricultural vehicles) and provide the VIN and Taxable Gross !eight. If your suspended vehicle exceeds the mileage limit, you will have to pay taxes.

IRS Payment Method

Once the tax due is calculated, choose any of the payment methods below to pay the HVUT taxes to IRS:

- Electronic Funds Withdrawal

- EFTPS

- Check or Money Order

E-File Form 2290

Once the payment is processed, electronically sign your return , add aPersonal Identification Number (PIN), and transmit the return to the IRS.

We have integrated with ExpressTruckTax, the #1 IRS-authorized 2290 e-file provider, to e-file your

Form 2290.

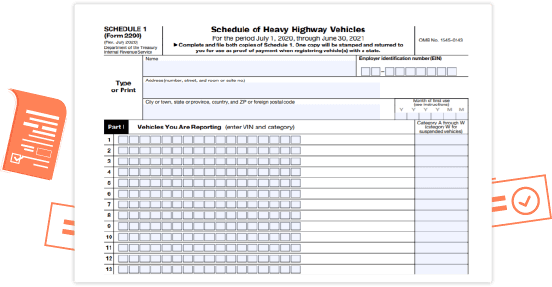

Receive Schedule 1

You will be notified when the IRS approves your return. Receive your Stamped Schedule 1 in minutes.

The Benefits of Filing Your Form 2290

with our Trucking Software

- Simple, quick, and, efficient filing method

- Re-transmit rejected returns for free!

- Free VIN Corrections for returns filed with us

- Avoid errors while filing

- Receive stamped Schedule 1 in minutes

- Instant notification when IRS accepts your return