ExpressTruckTax is the leading e-file 2290 solution for the trucking industry. 600,000+ American truckers can’t be wrong!

IRS Form 2290 Filing Instructions

- Updated June 29, 2023 - 8.00 AM - Admin, TrucklogicsThe IRS mandates truckers to file Form 2290 if they use a heavy vehicle with a gross weight of 55,000 pounds or more on public highways. Heavy Vehicle Use Taxes (HVUT) are used for highway construction purposes. The 2290 Form is due by August 31 each year.

Table of Contents:

- 1.What is the Form 2290?

- 2. What is the Form 2290 Schedule 1?

- 3. When is the Deadline to file Form 2290?

- 4. What information is required to complete Form 2290?

- 5. What is the Penalty for filing Form 2290 late?

- 6. What filing methods are available for Form 2290 ?

- 7.How does TruckLogics help users filing Form 2290?

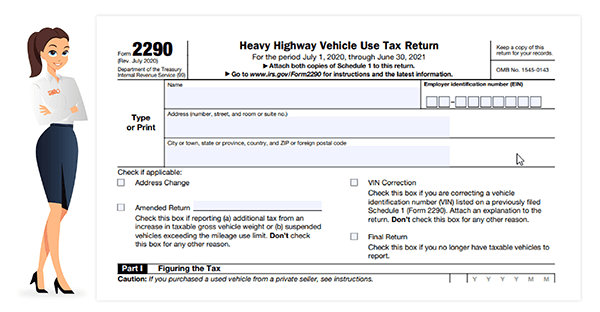

1. What is Form 2290?

The IRS Form 2290 is used to calculate and report annual Heavy Vehicle Use Taxes (HVUT). All commercial motor vehicles with a taxable gross weight of 55,000 pounds or more are subject to HVUT.

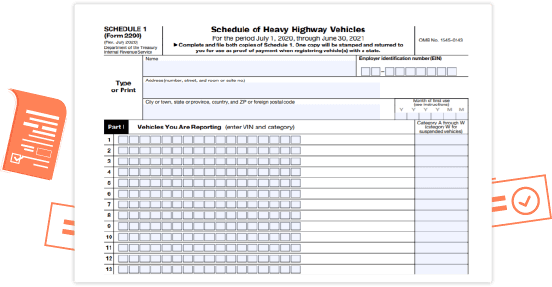

2. What is Form 2290 Schedule 1?

The Form 2290 Schedule 1 functions as proof of Form 2290 filing. Truckers are required to carry a current Schedule 1 in the cab of their truck.

3. When is the Deadline to file Form 2290?

The Form 2290 tax year runs from July 1 - June 31. If you put a new truck on the road during the tax year, your HVUT deadline will be the end of the month following the month of first use. For instance, if you started using a truck in October, your 2290 deadline will be November 30.

However, if you are still using the same truck as in previous years, your HVUT deadline will be August 31.

4. What information is required to complete Form 2290?

Owners of qualified commercial motor vehicles must provide the following information:

- Business name and address

- First Use Month (FUM)

- Vehicle Identification Number (VIN)

- Gross Taxable Weight

- HVUT Payment Method (check or money order, EFW, EFTPS, credit or debit card)

5. What is the Penalty for filing Form 2290 late?

If you miss your Form 2290 due date, the IRS will add a fee of 4.5% of your owed HVUT amount. For each additional month you delay paying the tax, the IRS will add another 0.5% interest.

6. What filing methods are available for Form 2290?

Trucking Businesses can file Form 2290 electronically or by paper.

Filing Form 2290 Electronically

E-filing Form 2290 is the method recommended by the IRS because it allows them to process your Form 2290 quickly. Unlike paper filing, the IRS will typically accept or reject your return within a matter of minutes. Additionally, you will get your stamped Schedule 1 in minutes! The IRS recommends that you e-file Form 2290 with an IRS-authorized Form 2290 e-file provider. Additionally, if you are filing for more than 25 trucks, the IRS requires you to e-file. E-filing Form 2290 is faster, easier, and more convenient.

The IRS recommends that you e-file Form 2290 with an IRS-authorized Form 2290 e-file provider. Additionally, if you are filing for more than 25 trucks, the IRS requires you to e-file. E-filing Form 2290 is faster, easier, and more convenient.

Paper filing Form 2290

When you paper file Form 2290, you will have to wait for it to get to the IRS. Additionally, it takes the IRS longer to process and accept paper forms. All told, it could take up to three weeks to get your Form 2290 accepted or rejected by the IRS when you paper file.

7. How does TruckLogics help users filing Form 2290?

TruckLogics has integrated with ExpressTruckTax, the market-leading IRS-authorized Form 2290 provider, to give our clients the ability to e-file their Form 2290 from the TruckLogics mobile app!

ExpressTruckTax provides a simplified interview-style filing solution with guaranteed acceptance and 100% US-based customer support!

Download the app today.