What’s New: TruckLogics now integrates with Samsara, the pioneer of the Connected Operations Cloud, for faster IFTA Reporting! Learn More

Calculate Your Taxes with the Free IFTA Calculator

Managing your IFTA reports can be tedious as there are a lot of calculations and paperwork involved.

Are you looking for the simplest way to calculate your IFTA taxes?

You are in the right place! With our IFTA Tax Calculator, you can easily calculate your IFTA mileage and Fuel taxes.

Steps to use our IFTA Calculator:

- Select the relevant options in the dropdowns:

Base jurisdiction, Fuel type, and Quarter. - Select a State from the list and then enter the Miles traveled and the gallons of fuel purchased in each state. You can add more rows if needed.

- Once you are done, you can click 'Calculate IFTA Tax' and view the Tax Summary Report.

Once you have filled in all the relevant details, enter your email address to receive your calculated tax report via email.

TruckLogics Now Simplify IFTA Tax Calculation

- Trucklogics provides you with the easiest way to generate and download your IFTA reports for the respective quarters.

- Our Motive Integration also allows you to import fuel and distance data, such as trip miles, fuel-ups, etc., from Motive ELDs automatically.

- With our EFS integration, you can directly import your fuel purchases from your EFS account for IFTA report generation.

- Changes in the IFTA tax rate made by different jurisdictions for each quarter are updated automatically in Trucklogics. Based on the rates, TruckLogics will automatically calculate your IFTA taxes.

Frequently Asked Questions

What information do I need for using this IFTA Mileage calculator?

Using our IFTA calculator, you can calculate your state tax and the total taxes due for the current IFTA quarter.

- Your Vehicle’s base jurisdiction.

- For which quarter are you reporting

- Your vehicle’s fuel type ( Eg: Diesel, Gasoline)

- The amount of fuel purchased (in Gallons), and the miles traveled in each state for the corresponding quarter.

What does Base Jurisdiction mean?

- Base Jurisdiction refers to the state or province where your vehicle information has been registered.

- All the records regarding the vehicles must also be maintained within the base jurisdiction.

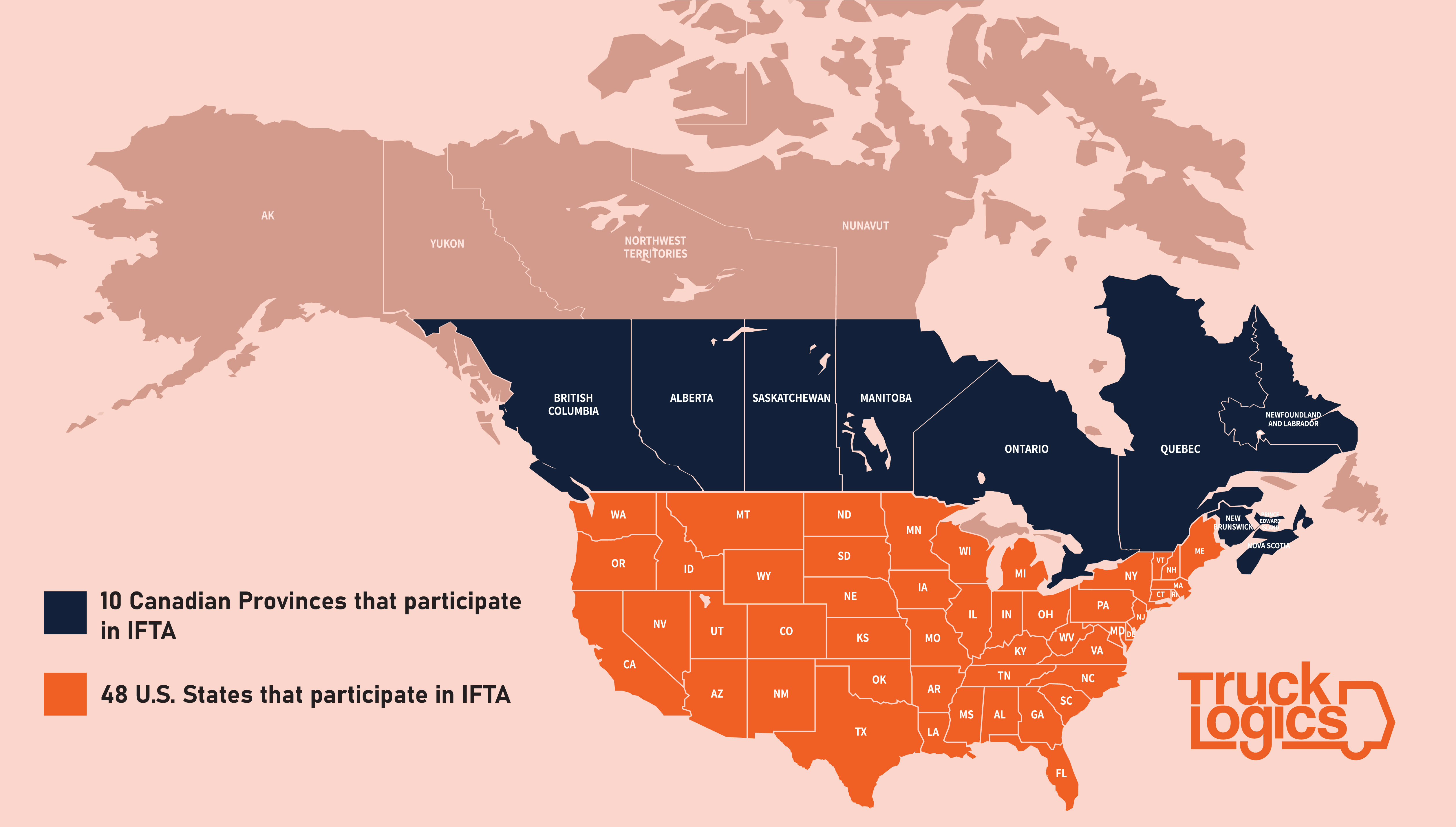

Who should file IFTA?

Qualified commercial motor vehicles that are involved in interstate transport between more than one U.S. state or Canadian province (member jurisdictions) are required to file a consolidated report of motor fuel taxes (e.g., gasoline, diesel fuel).

What is meant by IFTA Qualified Vehicle?

A vehicle is considered a qualified motor vehicle if it,

- Has 3 or more axles regardless of weight

- Has 2 axles and gross vehicle weight > 26,000 pounds or 11,797 kilograms

- Is used in combination when the registered gross vehicle weight is > 26,000 pounds

- Is not a recreational vehicle

When should I file IFTA?

| Quarter Periods | IFTA Quarterly Tax Return Due Dates* |

|---|---|

| 1st Quarter (January- March ) | April 30 |

| 2nd Quarter (April - June) | July 31 |

| 3rd Quarter (July - September) | October 31 |

| 4th Quarter (October - December) | January 31 |

If the due date falls on a weekend or a state holiday, the due date is extended to the following business day.