IFTA Fuel Tax Rates

Updated on February 3, 2023 - 2:00 PM by Admin, TruckLogics

Staying compliant with the IFTA reporting requirements is one of the main responsibilities of anyone who runs a trucking business. To comply with IFTA reporting every quarter, it’s important for trucking businesses to know about the IFTA tax rates for each jurisdiction and how it is calculated.

This article discusses in detail the IFTA tax rate and the calculations involved in determining it.

Table of Contents:

- 1. What is the Purpose of IFTA?

- 2. Who Should compliant IFTA Reporting?

- 3. What is the IFTA Tax Rate and how is it calculated?

- 4. What are the Calculations Involved in Determining the IFTA Taxes?

- 5. Why Being Aware of IFTA Tax Rate Changes is Crucial For Trucking Businesses?

- 6.When are the deadlines to complete IFTA Reporting?

- 7.How to meet your IFTA reporting requirements?

What is the Purpose of IFTA?

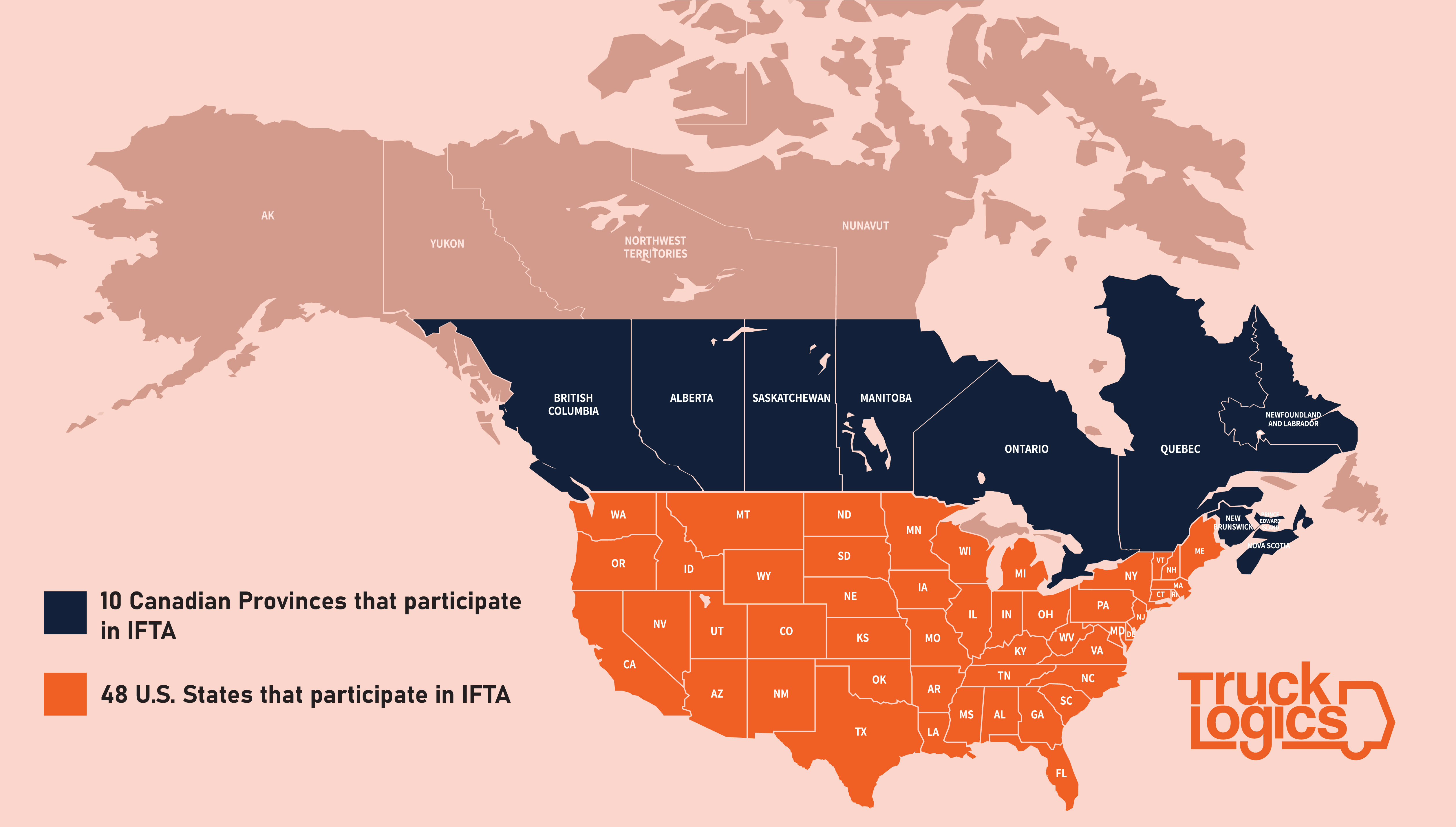

The IFTA (International Fuel Tax Agreement) is an agreement between the 48 contiguous states and 10 Canadian provinces regarding the fuel usage of commercial motor vehicles and its applicable taxes.

IFTA facilitates the reporting of fuel usage by commercial motor vehicles that operate in more than one jurisdiction. These fuel tax reports are used by base jurisdictions to collect net fuel taxes and redistribute the taxes to other states.

Who Should compliant IFTA Reporting?

IFTA reporting must be completed by qualified motor vehicles which meet any one of

the following criteria:

- Gross Vehicle Weight (GVW) 26,000 pounds or more

- Have three or more axles

-

Trucks involved in transporting commercial goods across state lines or the

U.S./Canadian border.

Drivers of these vehicles should report their fuel usage to their base jurisdiction (the state in which the vehicles are registered or maintained).

What is the IFTA Tax Rate and how is it calculated?

The IFTA tax rate is the amount of tax deducted per gallon of fuel consumed within the borders of each jurisdiction. The tax rate varies for each fuel type.

Each member jurisdiction of IFTA is allowed to set its own tax rate. These tax rates are subject to change frequently.

What are the Calculations Involved in Determining the IFTA Taxes?

To figure out the quarterly IFTA fuel taxes, you need to make sure that you have the

following information:

-

Overall Fuel Mileage

The overall vehicle mileage can be calculated by using the below formula:

Fuel Mileage = Total Miles traveled / Total Fuel Purchased - Total Miles Traveled in each state

- Fuel Purchased in each state (in Gallons)

-

Fuel Consumed in each state (in Gallons)

The below formula can be used to calculate the amount of fuel consumed in each state:

Fuel consumed in State X = Total Miles traveled in State X / Overall

Fuel Mileage - Fuel Tax rates of each state

-

Fuel Tax Required in each state

Use the below formula to figure out the amount of fuel taxes required by each state:

Fuel Tax Required in State X = Fuel Consumed in that State x Fuel Tax Rate of that State -

Fuel Taxes Paid in each state:

The amount of fuel taxes paid in each state is calculated using the below formula:

Fuel Tax Paid in State X = Fuel Purchased in that State x Fuel Tax Rate of

that State

Based on above data, you can find out the fuel taxes owed to each state using the below formula:

Fuel taxes calculation:

Fuel taxes owed to State X = Fuel taxes required in that State – Fuel taxes paid in that State

Want to Avoid All the Manual Calculations?

TruckLogics, our highly efficient IFTA reporting software, is automatically updated with the quarterly tax rates for each quarter, eliminating all of the complexity of manual IFTA report generation.

Why Being Aware of IFTA Tax Rate Changes is Crucial For Trucking Businesses?

For every quarter, some of the member jurisdictions may change the IFTA tax rates. These changes can have a significant impact on the IFTA reporting requirements of all trucking businesses that are involved in interstate dispatching operations.

Find out the IFTA Tax Rate Changes for the 3rd Quarter

With the deadline to complete the IFTA reporting for the 3rd quarter approaching, a few of the participating states have made considerable changes to their tax rates.

You can find a list of states with updated fuel tax rates for the 3rd quarter by

clicking the below button.

When are the deadlines to complete IFTA Reporting?

For each IFTA quarter, qualified motor vehicles should complete IFTA reporting with their

base jurisdiction.

Generally, the deadlines for IFTA reporting are:

- First quarter (January to March) - April 30

- Second quarter (April to June) - July 31

- Third quarter (July to September) - October 31

- Fourth quarter (October to December) - January 31

If the deadline falls on a Saturday or Sunday or any federal holiday, IFTA reporting can be completed on the next business day.

The deadline to complete the 3rd quarter IFTA reporting for 2022 is October 31, 2022.

How to meet your IFTA reporting requirements?

For trucking businesses, generating IFTA reports is easier than ever with TruckLogics. By allowing you to import your own fuel data and truck data, TruckLogics streamlines the process of

IFTA report generation.

Since our system is updated with the exact tax rates of all jurisdictions for each quarter, you never have to worry about the accuracy of your IFTA report. Also, you can easily convert miles to kilometers and gallons to liters if needed using TruckLogics.

Our internal audit check ensures you are only reporting mileage for adjacent states and adding fuel purchases for the states you traveled in.