Though the International Fuel Tax Agreement (IFTA) simplifies the reporting of fuel use by motor vehicles that operate in multiple jurisdictions, keeping track of the miles traveled and the fuel purchased in all participating jurisdictions can sometimes be overwhelming.

To file an IFTA report, it is not that one can go with the odometer reading of a vehicle and arrive at the total miles traveled. Instead, the challenge is to track the taxable miles. For instance, the fuel trip permit miles are not considered taxable miles. In addition, in some jurisdictions, the toll miles and

off-highway miles are not taxable.

On the fuel purchase, IFTA reporting needs specifics on the fuel purchased. What are the taxable gallons consumed? What is the tax paid for the fuel purchased in each of the participating jurisdictions? How do you arrive at these numbers to determine the tax liability to each jurisdiction? Also, not all fuel types need to be reported. For instance, purchases made on Reefer Fuel should not be reported. One mistake can cost you thousands of dollars.

Don’t worry! We have a solution for you.

How TruckLogics Helps Fleet Owners in IFTA Reporting?

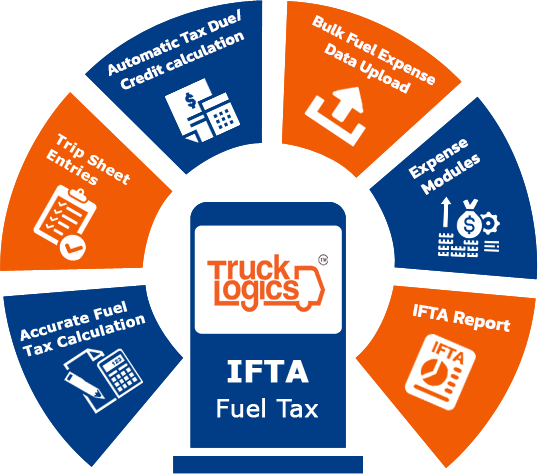

IFTA reporting can be one of the most time-consuming tasks for truck owners. The trucking solution from TruckLogics has features to automatically calculate the taxable miles based on the dispatch routes, allow recording of fuel expenses, and the generation of IFTA Reports for the base jurisdiction in a few simple clicks. It’s that simple!

Why TruckLogics?

Here’s what TruckLogics can offer:

- Trip Sheets to track the miles for each vehicle travels to deliver a load. Enter miles manually, use Google Maps, or have it filled automatically using ProMiles.

- Expense module to record fuel expenses with specifics such as location, fuel type, the payment received, reimbursable or not, and tax amount. For instance, reefer fuel can still be tracked but will not be considered for IFTA reporting.

- No more double entry for IFTA reporting. Automatically pulls up the information for the quarter being filed based on the travel dates the fuel expenses were incurred.

- Automatically calculates the tax rate for each jurisdiction for the fuel type reported.

- Automatically calculates the Tax Due/Credit Earned for each jurisdiction based on miles per gallon (MPG).

- Calculation of Interest on the tax due for late or amended returns.

- Calculation of Penalties for late-filed returns, failure to file, or underpayment of tax due.

- Calculation of Total Remittance based on the Tax Due/Credit Earned, Interest, and Penalties.

- Generates IFTA Report with instructions on filing, payments, and the

mailing address.

Case Study

David Smith, a Leading Fleet Owner uses TruckLogics to generate the accurate

IFTA Reports

Fleet Owner David Smith, with five vehicles, is using the services of TruckLogics to manage his trucking business. The Trip Log module allows David to track the miles his vehicles travel. The Expense module will enable him to record the expense incurred, including fuel expenses.

The Base Jurisdiction for IFTA filing is the State of Arizona (AZ). Two of his vehicles do not cross the state jurisdiction limit and need not be considered for IFTA Reporting.

Let us look at how David tracks the miles his vehicles traveled, record the fuel expenses, and file IFTA reports from within TruckLogics.

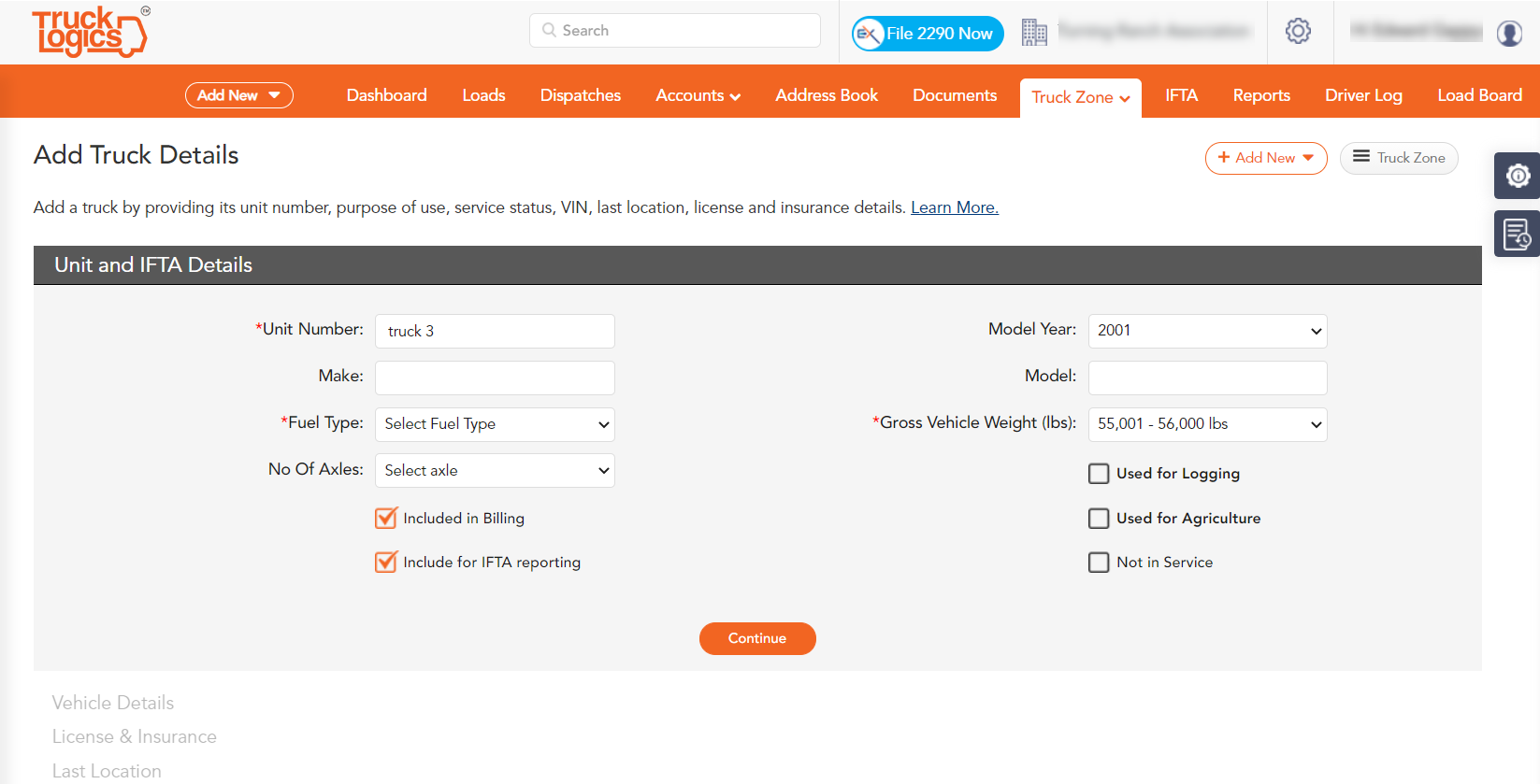

Inclusion of Trucks meant for IFTA Reporting.

David Smith would need an option to track only 3 of the five trucks for IFTA reporting. ‘The other two vehicles do not cross the State Jurisdiction limit of Arizona (AZ) and hence, are exempt from IFTA reporting.

TruckLogics allows vehicles to be added with the option to include/exclude them for IFTA reporting. When IFTA reports are automatically generated, only the miles and fuel expenses against those vehicles included in the IFTA reporting will be considered.

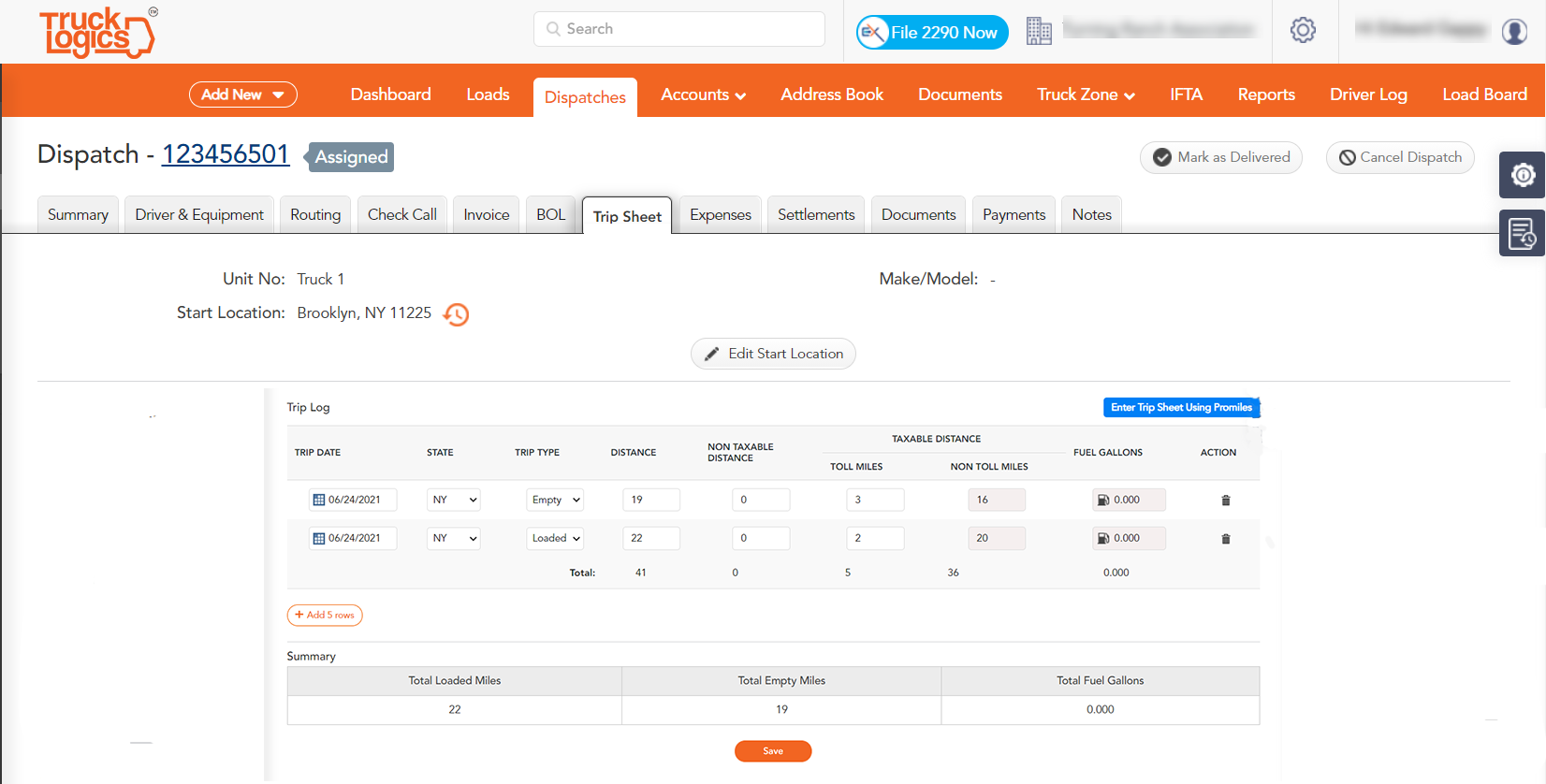

Tracking Miles Traveled in Each State Can’t

Get Easier.

Though David Smith can enter the miles traveled in the trip sheets manually or use Google Maps, he takes advantage of the ProMiles integration with TruckLogics by choosing the appropriate SKU that will allow the automatic calculation of miles based on the starting and ending location of a dispatch made.

ProMiles can identify the taxable and the non-taxable miles for a route. These being some of the key parameters for IFTA reporting, by using ProMiles, the calculations are guaranteed to be accurate.

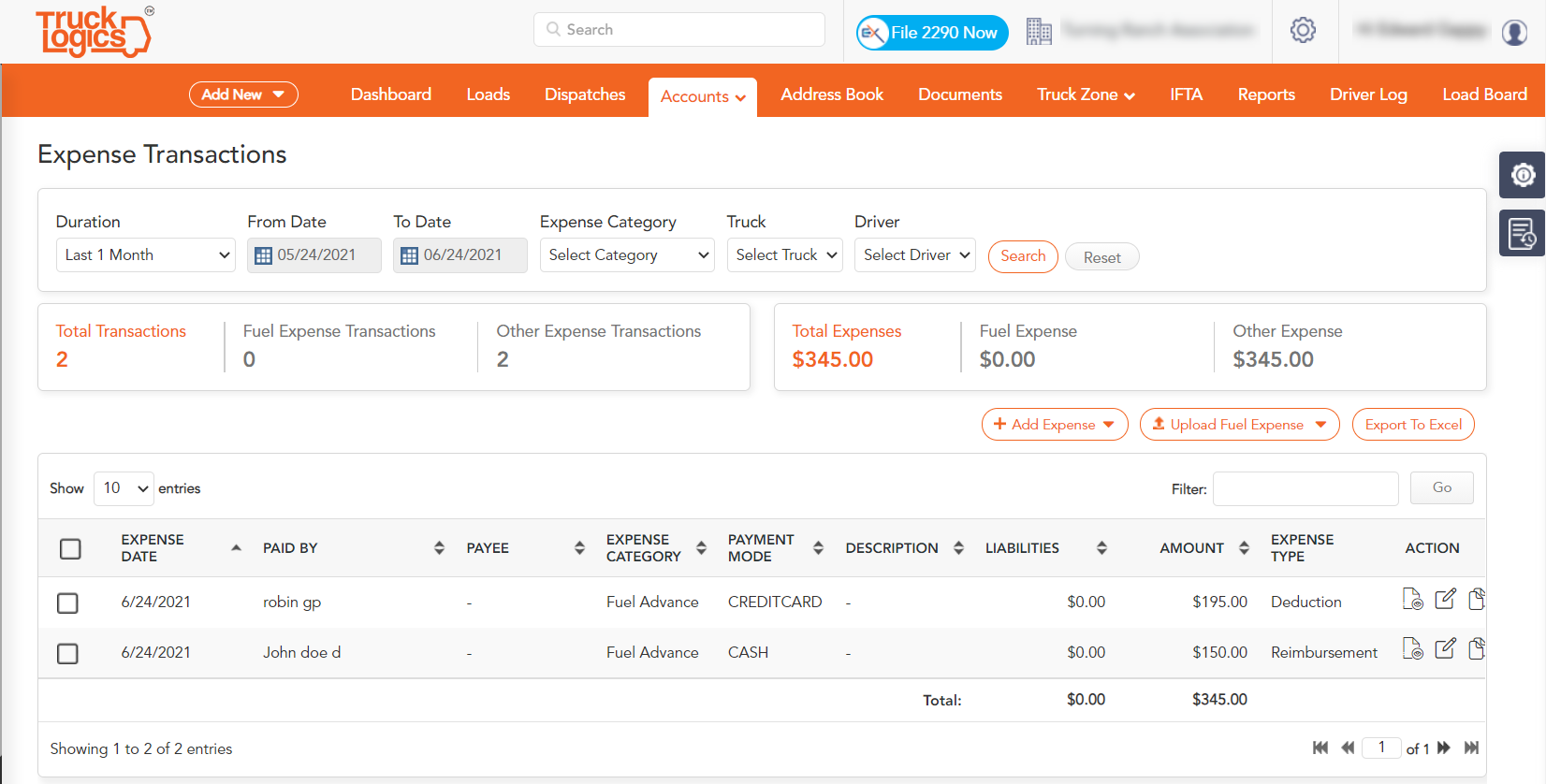

Adding fuel purchases

Recording of Expenses is the feature David Smith likes the most in TruckLogics. Expenses can be tracked for a dispatch under various expense categories with the expense date, mode of payment, location of the expense, types of fuels purchased, and the tax paid.

For IFTA reporting, expenses under the category Fuel Expense can be easily pulled up from Accounts >> Expense Transactions for the applicable fiscal quarter. When an IFTA report is generated, the applicable fuel expenses will be automatically pulled up.

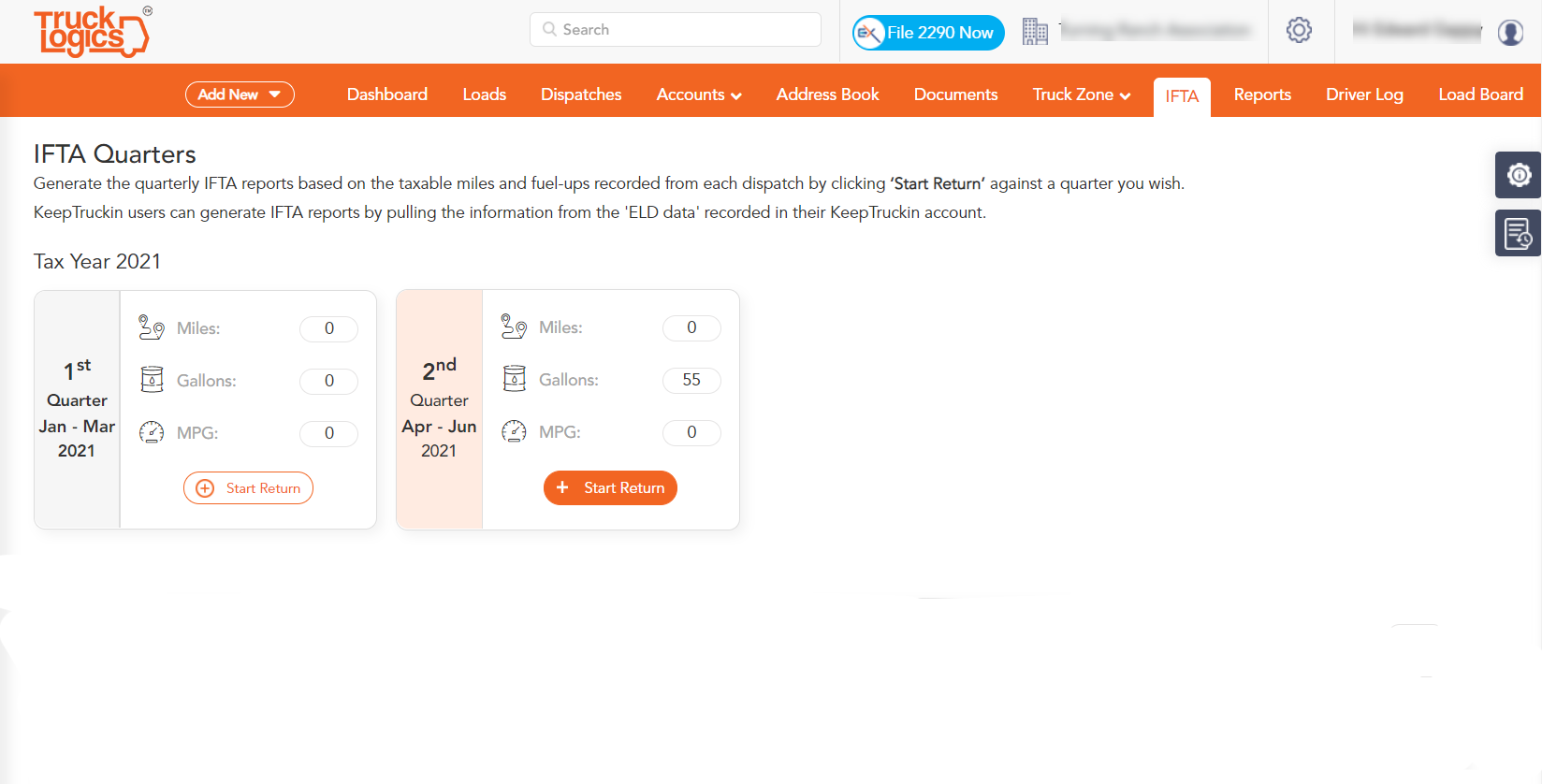

Time for IFTA Filing? No More Double Entries

The fuel tax agreement requires filing an IFTA report every quarter. For David, it's just a few clicks, and the IFTA report, along with instructions on the filing, is available for download in PDF format.

David Smith does not have to enter any information for IFTA reporting. Instead, TruckLogics automatically pulls up the Miles traveled and Fuel expenses for the 3 vehicles based on the travel date and the fuel expense date for the applicable

fiscal quarter.

Under the IFTA menu, options to file for the current and past quarters are available. Thus, if David had missed out on the IFTA filing for past quarters, he still could file IFTA, though penalties will be applicable.

Report IFTA on Base Jurisdiction

IFTA has to be reported every fiscal quarter through the licensee’s base jurisdiction, and IFTA taxes due must be paid by the deadline. In addition, the reporting requires fuel and mileage data broken down for each jurisdiction traveled.

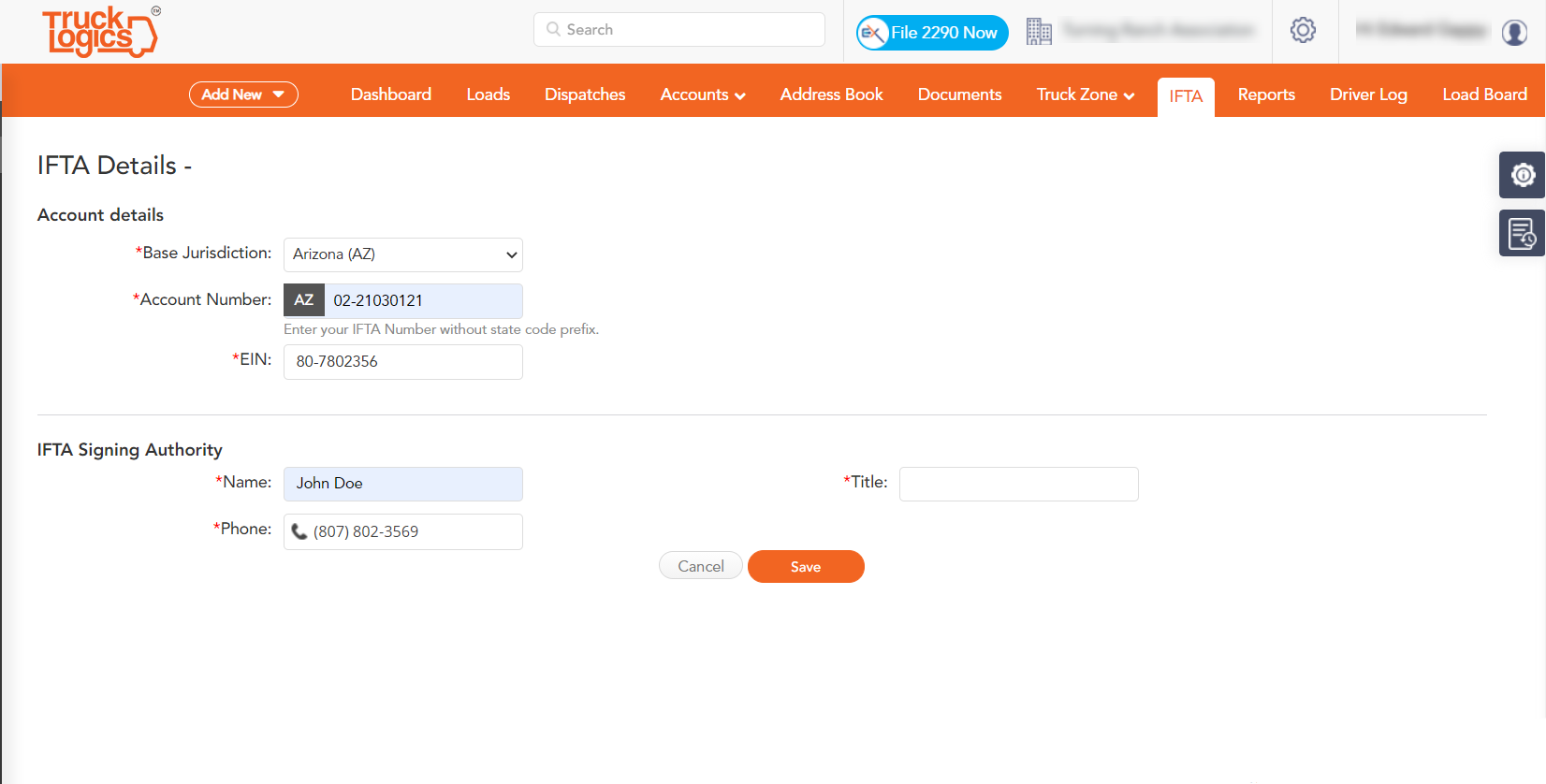

David Smith first set up the Base Jurisdiction and IFTA Signing Authority from

IFTA >> Settings before generating the IFTA report.

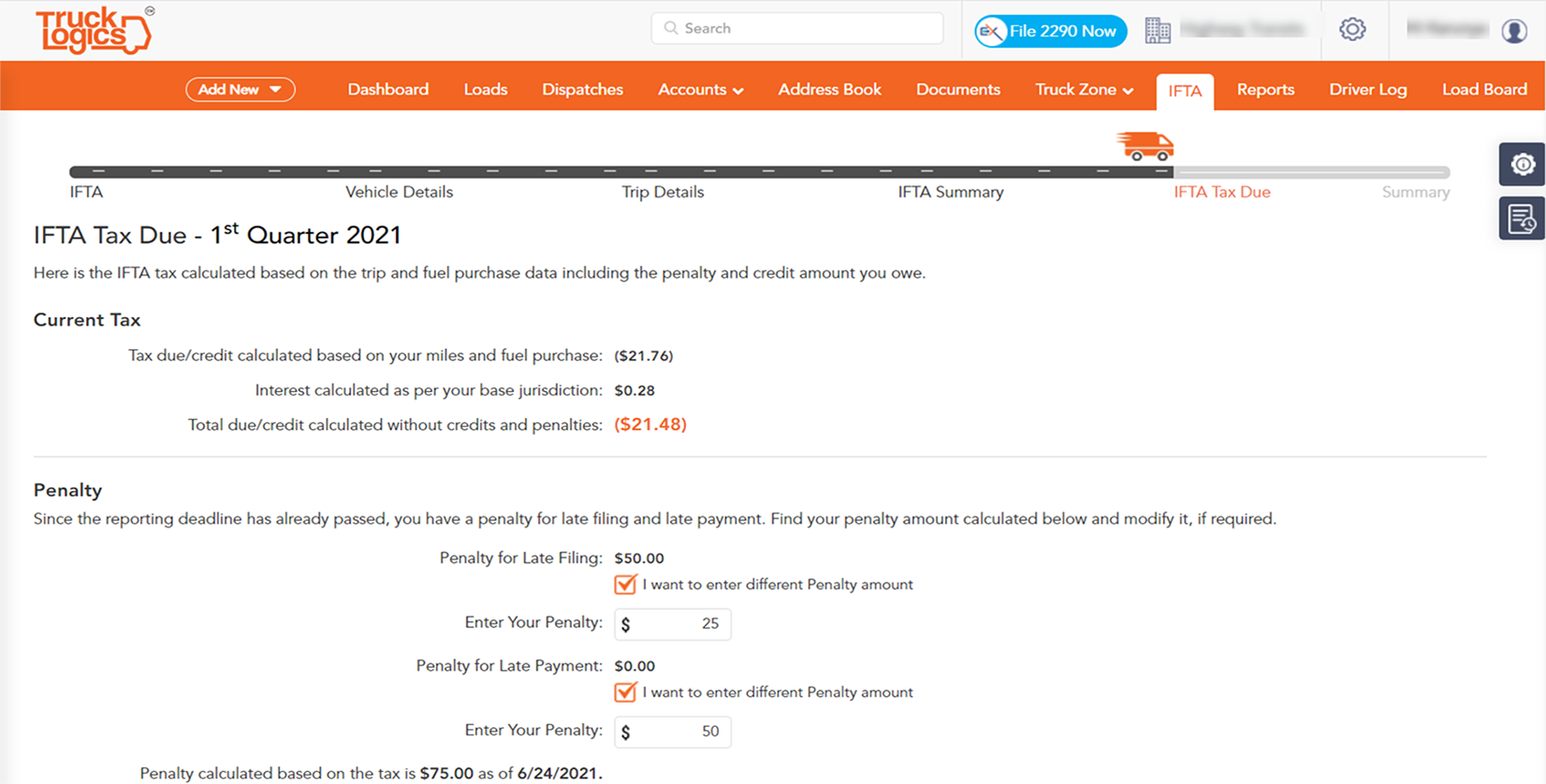

Calculation of IFTA Taxes and Penalties

A penalty of $50 or 10% of the net tax liability, whichever is greater, is assessed for late filing, failure to file, or underpayment of tax due. Thus, there is still a $50 penalty for late filing, even if the net tax liability is zero or a credit.

TruckLogics automatically calculates the interest on the tax due based on the base jurisdiction you choose. In addition, penalty, if any, for late filing and late payment is automatically accounted for, with the option to override these amounts based on the net tax liability.

Payments may be made by Check or Money Order.

Your IFTA Report is Ready

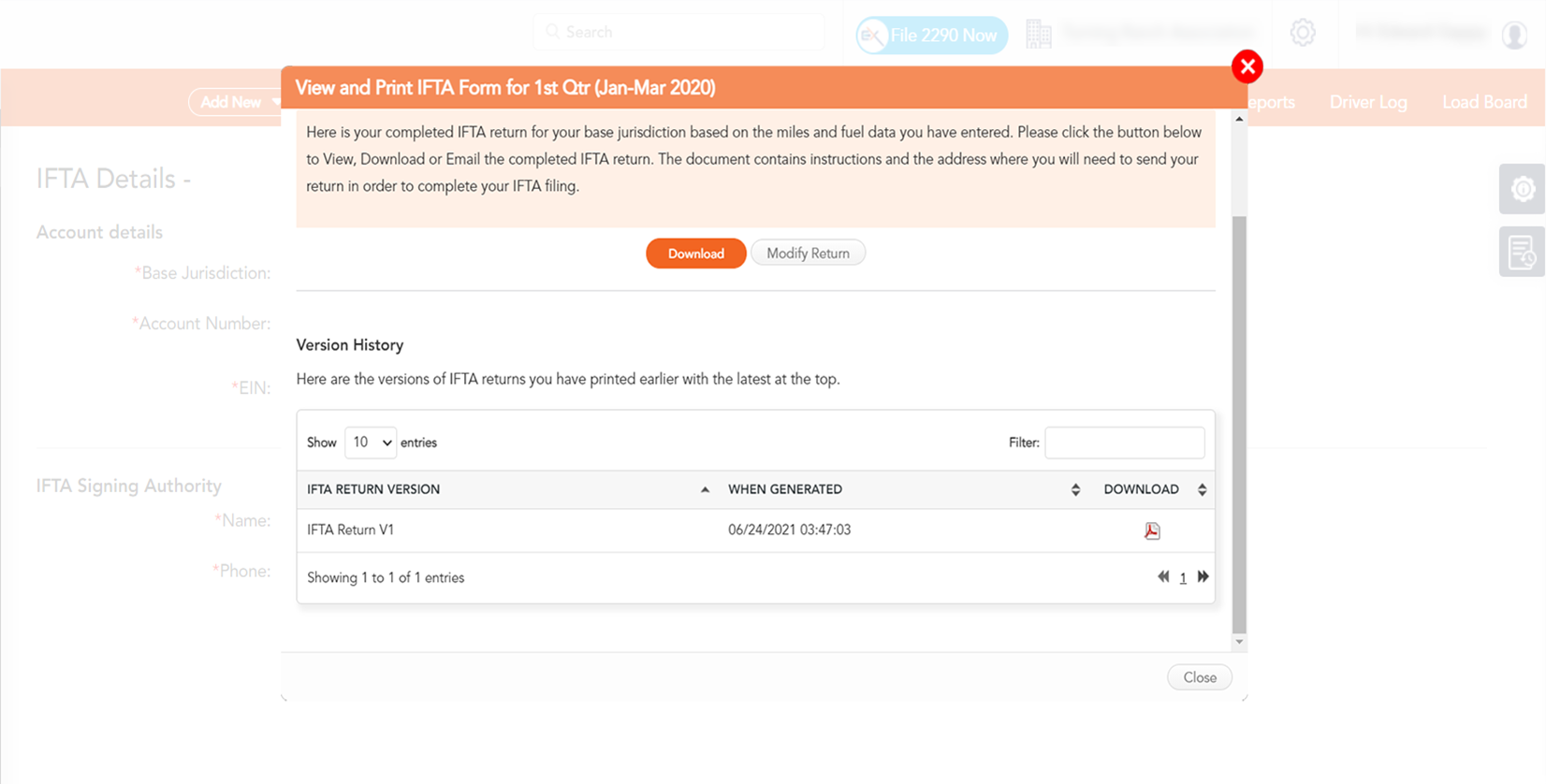

Based on the reporting quarter’s mileage and fuel expense information, the IFTA report is generated and is available for download in PDF format. The downloaded document contains instructions and the mailing address where the return is to be sent to complete the IFTA filing.

Corrections to the IFTA Report?

David Smith may have missed out on including the miles on a recent dispatch or incorrectly considered Reefer Fuel’s fuel expenses. Accommodating these in TruckLogics is very simple.

TruckLogics allows you to modify the IFTA report that was last generated. After making the corrections, upon clicking on Download IFTA Pdf, a new version of the report is generated. The earlier versions are maintained with the latest at the top for

future reference.

In Summary

TruckLogics is a one-stop solution for fleet owners to file their IFTA Reports from within their account based on the data available on the miles traveled by their vehicles and fuel expenses incurred.

For vehicles fitted with Motive’s Electronic Logging Devices (ELD), the Trip and Fuel reports from these ELD devices can be easily imported into TruckLogics, and IFTA Reports be filed seamlessly. For details on how Motive’s customers can file IFTA reports within TruckLogics, click here.

The article explains the feature in-depth and how TruckLogics simplifies IFTA reporting for truck owners or fleet managers.