What’s New: TruckLogics now integrates with Samsara, the pioneer of the Connected Operations Cloud, for faster IFTA Reporting! Learn More

IFTA - An Overview

Updated on April 07, 2025 - 2:00 PM by Admin, TruckLogics

IFTA stands for International Fuel Tax Agreement. Anyone who owns or operates interstate motor vehicles must be aware of the IFTA and what are the things needed for the IFTA reporting requirements are.

This article explains in detail about IFTA, how it works, reporting requirements, and deadlines.

Table of Contents:

What is IFTA?

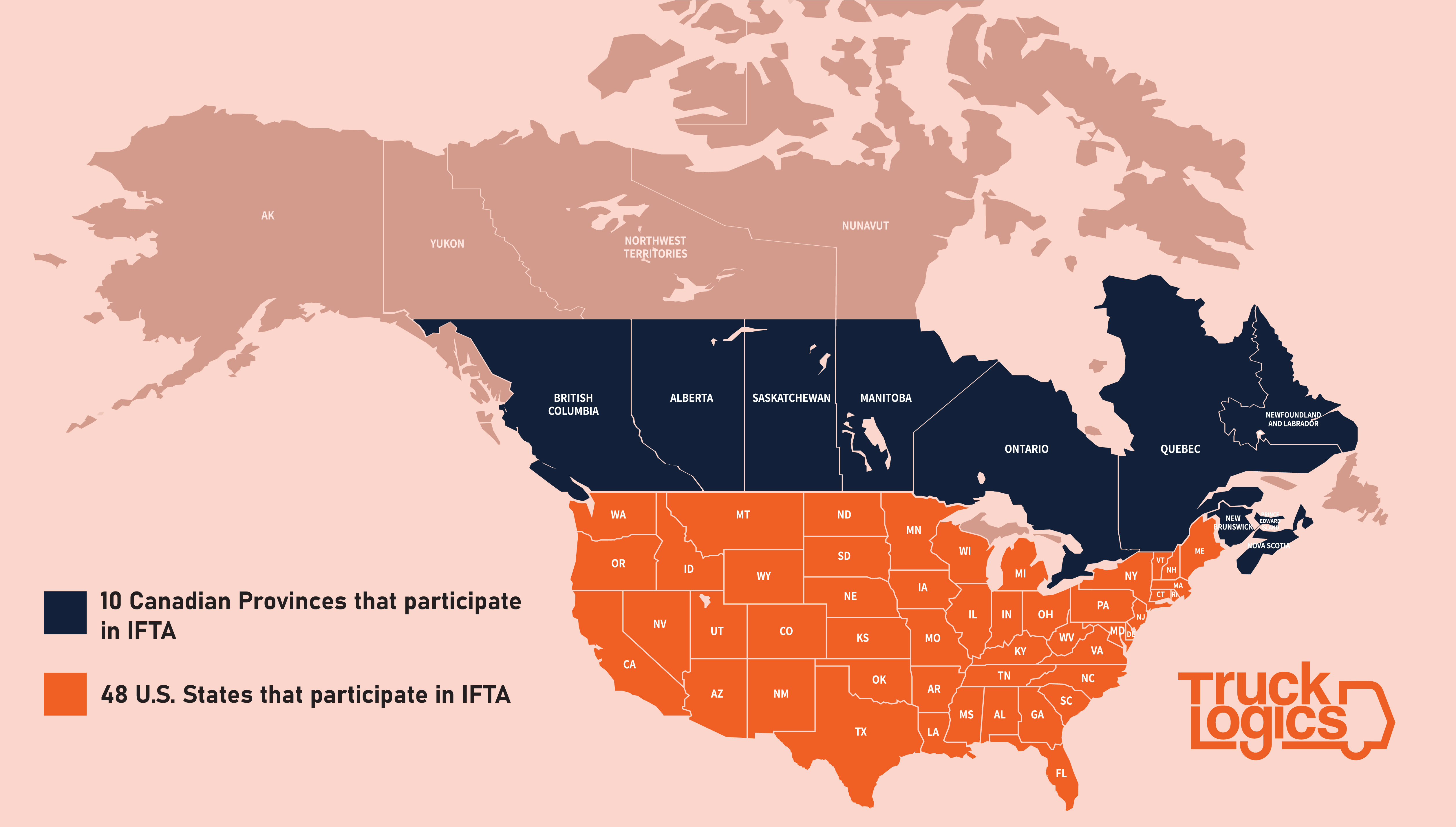

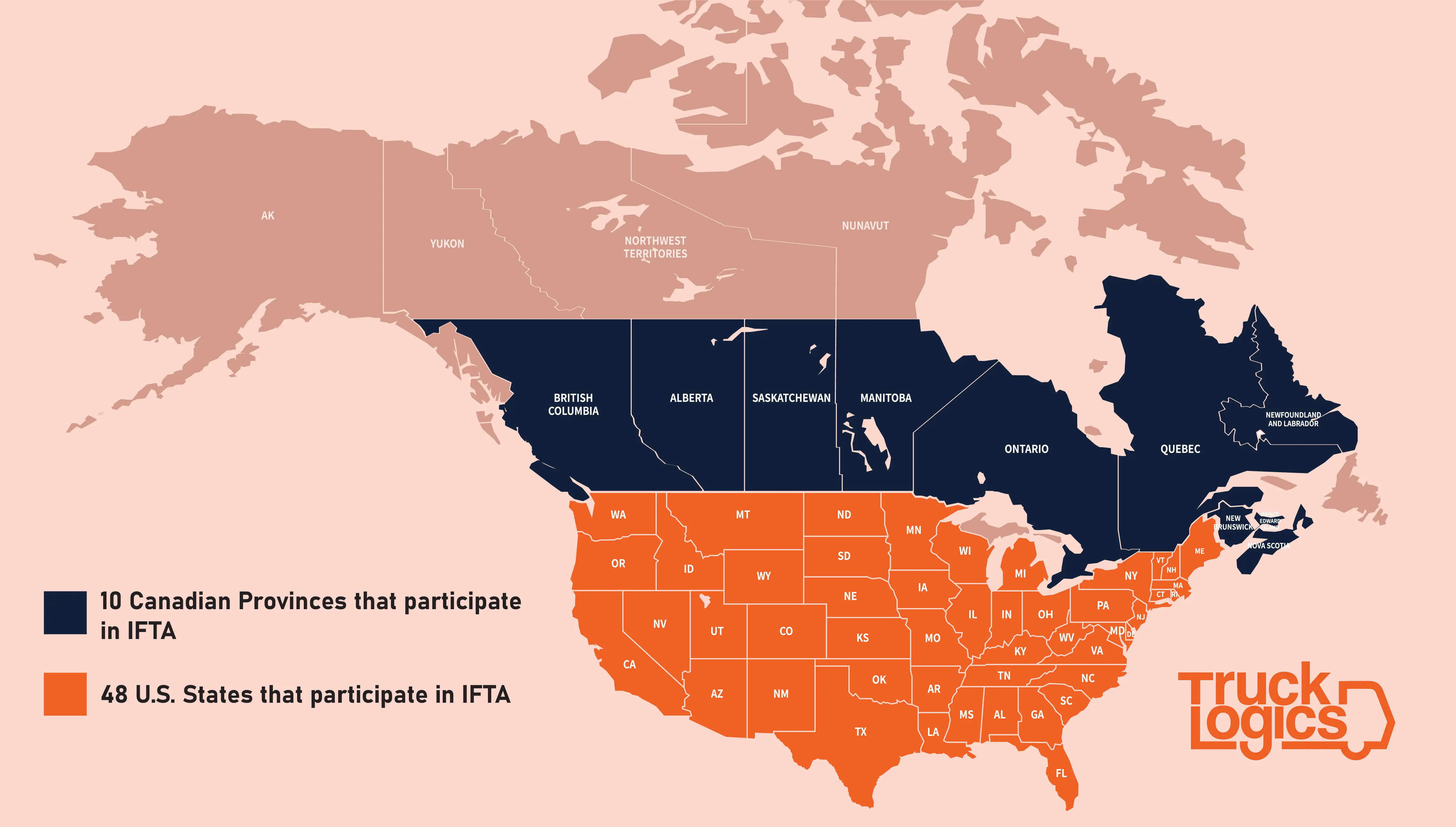

The International Fuel Tax Agreement (IFTA) is an agreement between the 48 contiguous U.S. states and the 10 Canadian provinces that facilitates the simplified way for truckers to pay fuel taxes. IFTA was adopted in 1996.

IFTA was created for truckers who frequently cross state borders on their routes. Trucking companies are relieved of some paperwork and fuel tax accounting and payment is made simpler.

Anyone who owns or operates a Qualified Motor Vehicle (QMV) in two or more member jurisdictions must obtain an IFTA license and decals from their base jurisdiction.

A vehicle will be considered QMV if they meet the following requirements,

- Has two axles and a gross vehicle weight of at least 26,000 pounds.

- Has Three or more axles

- Used in combination, when the weight of such combination exceeds 26,000 pounds of registered gross vehicle weight.

Once a qualifying vehicle obtains an IFTA License, the vehicle is allowed to travel through all IFTA jurisdictions and is only required to submit one fuel tax return per quarter to their base jurisdiction.

Below is the list of U.S. States and Canadian Provinces that fall under IFTA jurisdiction.

How to Apply for an IFTA License?

Owners of Qualified Motor Vehicles can obtain an IFTA license from their base jurisdiction. The process for applying for an IFTA license may vary from state to state. Some states require the truckers to submit an online application (Eg: California), whereas other states accept both e-filing and paper filing for IFTA License applications (Eg: Texas). The following information is required to apply for an lFTA license:

- USDOT number

- Registered business name

- Mailing address

- Federal Employer Identification Number (FEIN)

Note: Some states may require a few additional information.

Once your IFTA license application is processed, your state or provincial IFTA authority will issue two IFTA decals for each licensed vehicle for the current year. Some states may require a fee for IFTA license and decals.

If you don't have IFTA decals on your vehicle, you could face penalties depending on the jurisdiction. Failure to display your IFTA decals, on the other hand, can result in fines ranging from a few hundred dollars to several thousand dollars.

What is Quarterly IFTA Fuel Tax Reporting?

To their base jurisdiction once after receiving the IFTA license, the owners or operators of the QMVs are required to submit a quarterly IFTA fuel tax return to your base jurisdiction.

Using the information reported on the quarterly IFTA reports, the base jurisdiction enables the licensees to meet their fuel tax requirements easily.

The licensee must have the following information available to prepare your IFTA Report:

- The truck/unit number, gross vehicle weight, fuel type, fleet name, fleet number, manufacturer, and model of the vehicle.

- Business information such as the EIN, company name, type of business, and address.

- The total distance traveled by the IFTA licensee's qualifying motor vehicle(s) in all the member jurisdictions.

-

Overall Fuel Mileage

Overall Fuel Mileage = Total Miles Driven / Total Gallons

-

The total gallons or liters of fuel purchased for a qualified motor vehicle in each

member jurisdiction. -

The total gallons or liters of fuel consumed by a qualified motor vehicle in each

member jurisdiction.

Fuel Consumed in a specific state or province = Total Miles Driven in a specific state or province / Overall Fuel Mileage

-

Fuel Tax Required in each state

Fuel Tax Required in a specific state or province = Fuel consumed in that state or province x Fuel tax rate of that state

Click here to find the IFTA tax rate.

-

Fuel Tax Paid in each state

Fuel Tax Paid in a specific state or province = Fuel purchased in that state or province x Fuel tax rate of that state

Based on these details, the fuel taxes owed by the licensee can be calculated and reported on their IFTA Reports. To learn more about the IFTA reporting requirements, click here.

When are the deadlines to file IFTA Report?

Here are the IFTA return due dates for each quarter of the tax year,

| Quarter | Period | Deadline |

|---|---|---|

| First Quarter | January to March | April 30 |

| Second Quarter | April to June | July 31 |

| Third Quarter | July to September | October 31 |

| Fourth Quarter | October to December | February 02 |

How to file IFTA Report?

Depending on the base jurisdiction, there are two ways to file an IFTA Quarterly Fuel Tax Return.

- Online

Click here to learn more about how to file an IFTA return with your base jurisdiction.

Choose TruckLogics to Generate Your IFTA Report Accurately!

For generating IFTA reports in state-specific forms, TruckLogics provides a comprehensive solution.

The fuel and distance data can be manually entered, or you can use our Excel template to import the data bulk. Additionally, TruckLogics allows for the import of Motive data for FTA reporting.

Based on distance and fuel data, our IFTA Reporting Software will accurately calculate the fuel taxes and make automatic tax rate adjustments for all jurisdictions every quarter. Miles to kilometers and gallons to liters conversions are also available.

If the current state is not adjacent to the previous state, a State Adjacency check will be conducted, and an error message will be provided.

Ready to generate your IFTA Report with TruckLogics?

Generate your IFTA Report NowOnly pay for the report you generate

Frequently Asked Questions

What is the purpose and benefit of IFTA?

The International Fuel Tax Agreement (IFTA) was created to make transferring fuel taxes between states and provinces easier.

Operators only have to report their fuel usage to their base jurisdictions, and they will collect and distribute taxes on net fuel consumption to other jurisdictions. The base jurisdiction is also responsible for enforcing compliance through frequent IFTA audits.

What states/provinces are not included in IFTA?

Below are the following Non-IFTA jurisdictions/provinces:

| United States | Canada |

|---|---|

| Alaska | Yukon Territory |

| Hawaii | Northwest Territory |

| District of Columbia | Nunavut |

How long must records be kept?

IFTA records must be kept for four years after the filing or due date of the tax return, whichever comes first.

What is the difference between IFTA miles and Non-IFTA Miles?

International Fuel Tax Agreement miles, or IFTA miles, are all miles or kilometers your vehicle traveled in the territory that is covered under IFTA during the quarter, including empty or deadhead miles.

Miles driven in non-IFTA jurisdictions are known as Non-IFTA Miles. These jurisdictions include Alaska, Hawaii, the District of Columbia, the Yukon Territory, the Northwest Territories, Nunavut, and Mexico.

What does IFTA flagged mean?

Failure to file returns, pay taxes on time, or both can result in a "flagged" account. You will be unable to renew your license or order more decals as a result of this. If your account has been flagged, a red alert will appear on your “User Home Page” next to your account name and number, informing you that your account has been flagged.