What’s New: TruckLogics now integrates with Samsara, the pioneer of the Connected Operations Cloud, for faster IFTA Reporting! Learn More

Recent Webinars

Accurate and Automated IFTA Software

Easy Data Import Options

TruckLogics offers multiple ways to import the distance and fuel data required for generating your IFTA Report.

-

Manual Entry

Enter the distance traveled, fuel type, and fuel purchases for each jurisdiction manually.

-

Bulk Upload

Use our easy-to-use Excel templates to quickly import your distance and fuel data in bulk. TruckLogics offers two different templates.

-

Import from Motive and Samsara ELDs

TruckLogics now provides Motive and Samsara Integration. You can connect your account and import your trucks , miles traveled

and fuel purchased.

Accurate Tax Calculations

Just enter your distance and fuel data, and our system will do the rest!

- Automatic Tax Rate Updates

- IFTA Tax Calculations

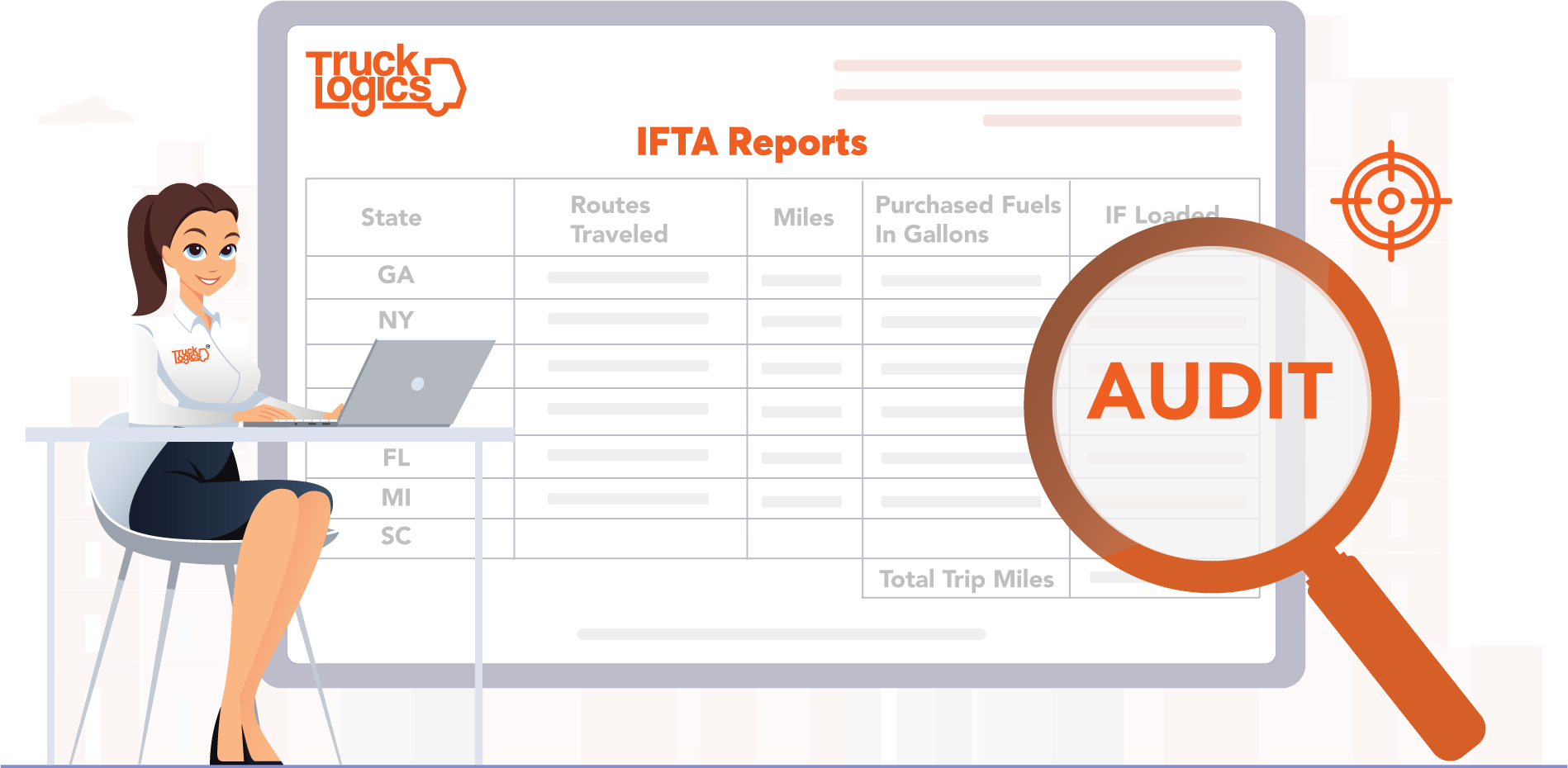

Audit Check for Accuracy

TruckLogics will automatically audit your data to ensure the accuracy of your IFTA Reports.

Generate a File-ready IFTA report

TruckLogics allows you to generate an IFTA Report in State specific formats.